- This is how the economy arrives at 10-N (I). Each pensioner 'owes' and 10,863 euros to Social Security

- Tribune: Public pensions: beyond the CPI

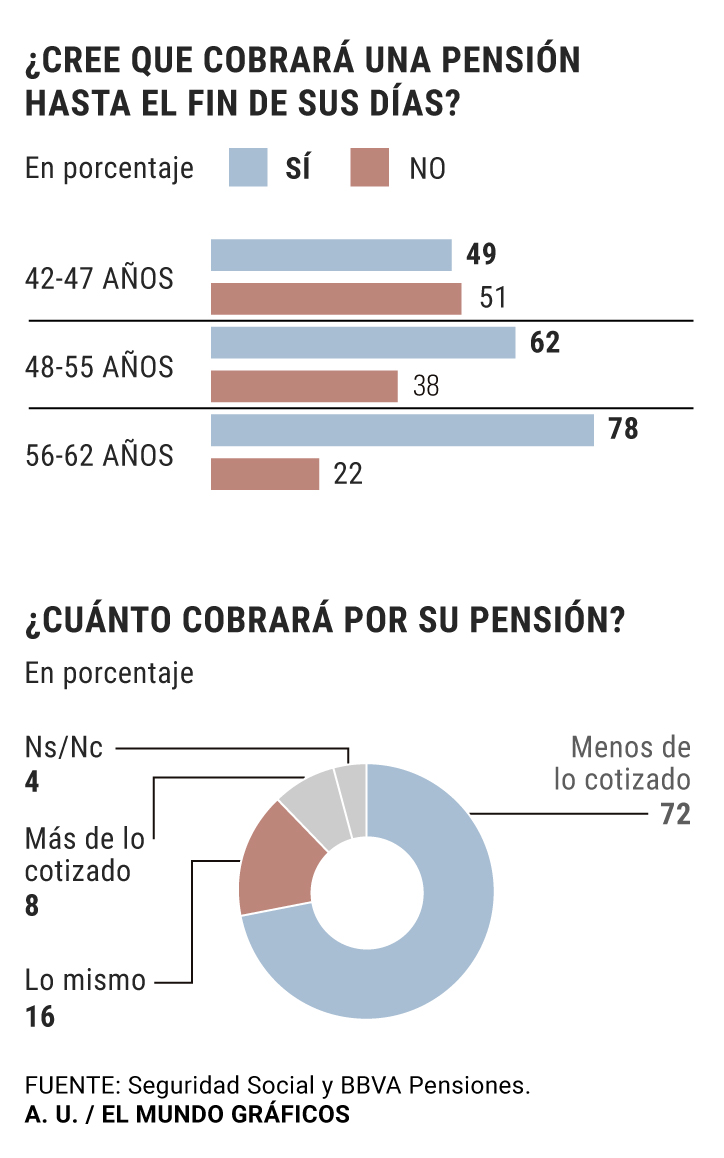

A very notable part of the workers - and of the pensioners themselves - have the assurance that their contribution to Social Security during working life far exceeds what they will subsequently receive through the retirement benefit. This is evidenced by works such as that of BBVA Pensiones, which yesterday published a survey conducted among citizens of the baby boom generation and in which 72% of respondents say they will receive less than what they contributed through social contributions. And nevertheless, according to the calculations of the same organism, the reality is that « each pensioner receives, on average, 30% more than the quoted in his working life ».

«Three years of contribution finance approximately one year of pension. Therefore, a 40-year career would finance 13 years of pension, but the average duration of the retirement pension is currently around 17 years, ”added from the BBVA Pension Institute.

There is, therefore, an average benefit of about four years that much of the population does not know . Especially wrong is the perception among the youngest baby boomers , which are what they are currently between 42 and 46 years old: in this group of citizens, the claim that they will receive less than the contribution is triggered up to 76% of cases , while only 14% are aware of reality.

The work carried out by the division of the entity specialized in pensions also offers another very revealing fact. Among the same group of people born in the last years of the explosion of birth in Spain (a phenomenon that BBVA covers from 1957 to 1977), only 49% of those asked estimate that they will receive a pension until the end of their days. Or to put it another way, that more than half of the workers between 42 and 47 years of age consider that they will not have a guaranteed benefit until they die , while among those between 48 and 55 years the figure still amounts to 38% and It stays at 22% among those who are closer to retirement.

But this impression seems, once again, unwise, since the commitment of the political forces is, in all cases, to maintain the pension system. The differences that exist focus on the way in which they should be revalued, and only Vox goes further by proposing a change of model towards a mixed system that could involve the privatization of a part of it. But what everyone agrees on is the need to secure pensions.

What could happen, as some experts have warned on more than one occasion, is that the system be forced in such a way and without taking the necessary measures that, after a future crisis, the European Commission could demand a cut in pensions. Something similar to what happened in Greece during the worst years of the crisis, although for this it would be necessary to reproduce a scenario as adverse as unlikely. And even so, the State would continue to guarantee the benefits cut during the lifetime of the recipient.

This very unlikely scenario could be reached, for example, by linking pensions indefinitely to the CPI, which is what parties like the PSOE or Podemos propose and claim the vast majority of respondents. This position is still contradictory because, while they fear that the benefits do not cover their entire retirement period, they demand precisely what generates more pressure for the system. Specifically, 84% of respondents argue that the Government must always ensure the purchasing power of pensions by revaluing them according to inflation, while only a considerable 11% acceptable that indexation is not carried out if Social Security It is in an adverse situation.

According to the criteria of The Trust Project

Know more- Social Security

- Pensions

This is how the economy arrives at 10-N (I) Each pensioner 'owes' and 10,863 euros to Social Security

In October Pension expenditure reaches a record 9.710 million, 4.9% more

Reserve Fund The Government of Sanchez will leave just 1.5 billion in the 'piggy bank' of pensions after the extra Christmas