Well-known is the interest of the executive president of Telefónica, José María Álvarez-Pallete, for running . There is a race to complete that requires training and the best conditions to face it, but there is no way to know its route. The path that opens before the telecommunications sector is unknown. Competitors refine their templates: less bulky, younger, with inevitably technological profiles. Telefónica itself will exceed 40,000 departures in the 21st century, once the casualty plan undertaken this week is closed and will be developed until the end of the month.

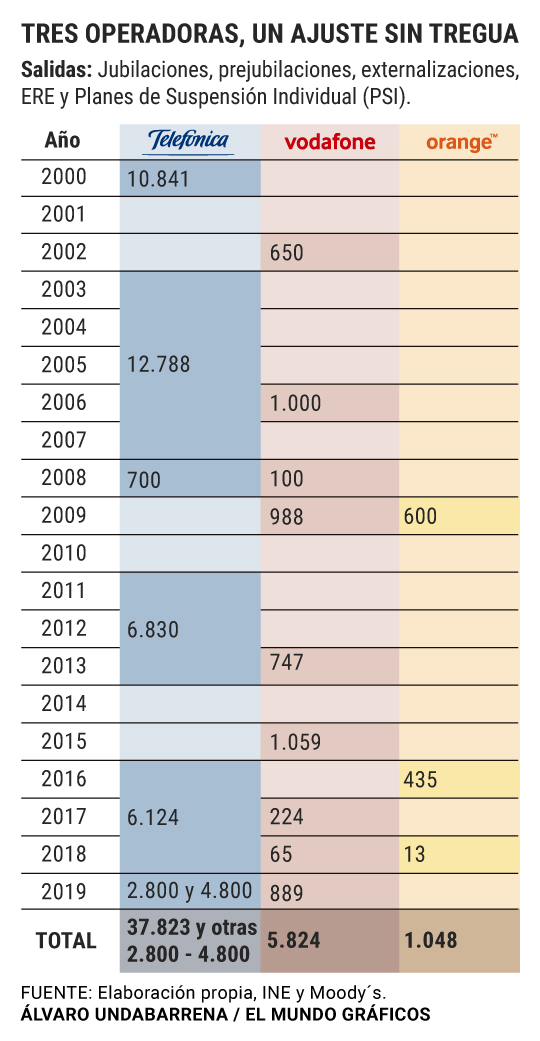

According to data collected by EL MUNDO, the multinational has accumulated 37,823 casualties since 2000 , to which will be added the new Individual Suspension Plan (PSI). This new process, voluntary, is open to a figure of up to 4,800 workers, but, in view of the economic provision, the final figure could be around 2,800 casualties. Whatever the calculation within that fork, the company will exceed 40,000 departures in the present millennium. Today, Telefónica España has 25,000 employees.

The case of this company is not unique. Among the three major operators in the home market, more than 44,000 departures have been calculated since 2000. When the Telefónica process is over, the combined figure of 47,000 casualties will be exceeded. If all potential employees were accepted into the PSI, the sector would achieve a joint reduction of around 50,000 employees in these 19 years.

In Vodafone, this same exercise has been triggered by an Employment Regulation File (ERE) that, between layoffs and retirement, has affected 889 employees, 17% of a workforce that encompasses around 5,100 workers before this ERE. The "difficult, but necessary" measure is explained because "the telecommunications market faces strong pressures on business margins," according to the Portuguese António Coimbra, president and CEO of Vodafone Spain, earlier this year.

In the national branch of this British company, only four years have elapsed since the previous ERE, which in 2015 left another 1,059 departures. The new Vodafone would be adjusted in a workforce of around 4,200 people.

Orange, which would have removed Vodafone as the second largest operator in the country, currently brings together 7,599 employees in its Spanish workforce.

Price war

«It is one of the sectors in which there is more competition, more price wars ; the one that has undergone a greater digital transformation. The profit margin has narrowed ”, synthesizes EL MUNDO professor, lawyer and consultant Borja Adsuara, former CEO of Red.es.

In its negotiations, Telefónica has obtained support from the unions from the outset, to offer a plan for those over 53 with 68% of the salary until they reach 65. Within forced retirement, about 300 of the total plan, Each exit is expected to involve two signings; Half of these profiles will be under 35 years old. In addition, the multinational starts a reskilling program so that more than 6,000 employees update their digital skills. "The challenges and difficulties have to do with automation processes, the application of Big Data and Artificial Intelligence to the business," adds Adsuara.

That is, the templates have been depleted, no doubt, but it seems more correct to talk about a conversion, in view of the incorporations and the optimization of the employees' knowledge. In 10 years, telco jobs are approximately 33,000 less. «Without a doubt, it is a sector that is very affected by technological change, which seems to never end. Manufacturers have already made that leap in 2002 , after the bursting of the technology bubble, but operators are not yet optimized, ”believes Miguel Canalejo, independent director of Orange and former president of Alcatel and Redtel.

Facebook bills

The sector faces an unavoidable renovation. An a priori privileged position in the digital era has not been enough: they have ended up imposing, also in this business, internet giants like Facebook, with the WhatsApp application among their assets. « Telecos have seen how in a few years digital companies have emerged that, not only have come to compete, but they are taking away their traditional businesses: first, the SMS business, with WhatsApp, and then, the voice business , with IP connections . For this reason, they have tried to enter the management of premium content (football, movies, series ...), but there is also a strong competition (Netflix, HBO, Amazon ...) », reviews Adsuara.

In this scenario, the Consumer Price Index (CPI), on the rise, progressively separates its path from the CPI from the telco sector, in decline. «Telecommunications is a deflationary sector, the only economic sector that has reduced its prices in the last 10 years, both in fixed and mobile communications. This happens for two reasons: technological change lowers costs and competition here is very strong. Consequently, revenues have not stopped falling, ”says Canalejo. Billing for retail services, which have the greatest weight, has dropped 40% in 10 years, by 28% if wholesalers are also taken into account.

From voice to data

The business has jumped from the voice to the data: calling by phone or sending an SMS message are considered commodities by some users, who take these services for granted. "Nobody has found a killer application like the SMS, which was very profitable and suddenly disappeared when WhatsApp appeared," recalls Canalejo. No wonder, therefore, that companies insist on packaging voice, data and television, if necessary, within the so-called convergent offers. For Telefónica, revenues from broadband and digital services were limited in 2012 to 28% of its turnover, but last year they already reached 53%.

Last Monday, Álvarez-Pallete valued in Brussels to a group of Europarliamentarians that the telecommunications sector represents approximately 5% of the Gross Domestic Product (GDP) of the continent. On Friday, in La Toja, the president of Telefónica called attention to the fact that " Europe led the telco industry in the 80s and 90s, and yet it is not present in the equation ." Canalejo emphasizes the conditions of this market: «We have only to see the situation in the US, where there are five operators with their own network, and Europe, where there are a hundred, although the size of both markets is similar. In addition, the three largest operators in Spain are among the largest in the continent, which would make any merger difficult.

Moody's has recently warned that, while community GDP goes up, telco revenues go down. " If there were a recession in the coming years, the industry is less prepared than it was before the last one," Carlos Winzer, senior vice president of the agency, said in that analysis. This report also warns that any cost reduction seems complicated, since it is necessary to invest in 5G networks, the standard that will support the mobile phone of the future - Vodafone advanced marketing last summer. The operators, also in 5G, will continue calling the business, waiting for answers.

Three operators and a room on the prowl

The three major operators, Telefónica, Orange and Vodafone, are attending the rise of a quarter, MásMóvil, which emerged in 2006 due to the conditions imposed by the Competition authorities on the merger of Orange and Jazztel. The one that was supposed a secondary actor has entered the Ibex and last Tuesday he starred in one of the most pronounced rises of recent times in the selective: 21% at the end of the session on Tuesday. The company had reached an agreement with Orange to, prior disbursement, use the mobile and fiber optic networks of this company. “Regulators insist that they want four operators, so there are not many other options apart from sharing networks,” describes Miguel Canalejo.

To this is added the aforementioned fourth operator, which since 2016 also integrates Pepephone and Yoigo. The staff of the MásMóvil group is currently around 800 workers.

Not only that: the fourth operator adds the threat of a fifth: the new Euskaltel, in which the Zegona fund has become strong. This maintains different agreements with the British Virgin, some pacts that invite you to think about a hypothetical expansion of that brand by the Spanish geography to compete fully in mobile communications, as well as in homes.

According to the criteria of The Trust Project

Know more- Telefonica

- Spain

- GDP

- Europe

- Netflix

- José María Álvarez-Pallete

COMPANIES Digital users, tiny taxes: Google, Apple, Facebook and Amazon pay 23.9 million a year

InternetLibra, Facebook's challenge to the financial system, is delayed by the panic of banks and governments

LaboralTelefónica justifies its casualty plan for the war between operators last summer