- Project: The Bank of Spain warns of the slowdown: growth forecast sinks and lowers job creation

Less growth, stagnation in the creation of jobs, exhaustion of domestic demand, brake in real estate activity ... The signs of deterioration of the Spanish economy are numerous and, although many of them could already be seen for months, The deep downward revision that the Bank of Spain carried out last week on the macroeconomic chart confirmed them. And this, in addition to being an element of concern for the population, is a notable setback for the election campaign of the acting president, Pedro Sánchez .

The strength of the economy was one of the great strengths of the PSOE for the elections on November 10, an argument that cannot be enjoyed by the rest of the forces and which Sanchez and his economic ministers have wanted to seize at all times. Moreover, they will probably continue in the election campaign. But the data and the economic context say otherwise: that it is the first elections in slowdown since the crisis .

Increase

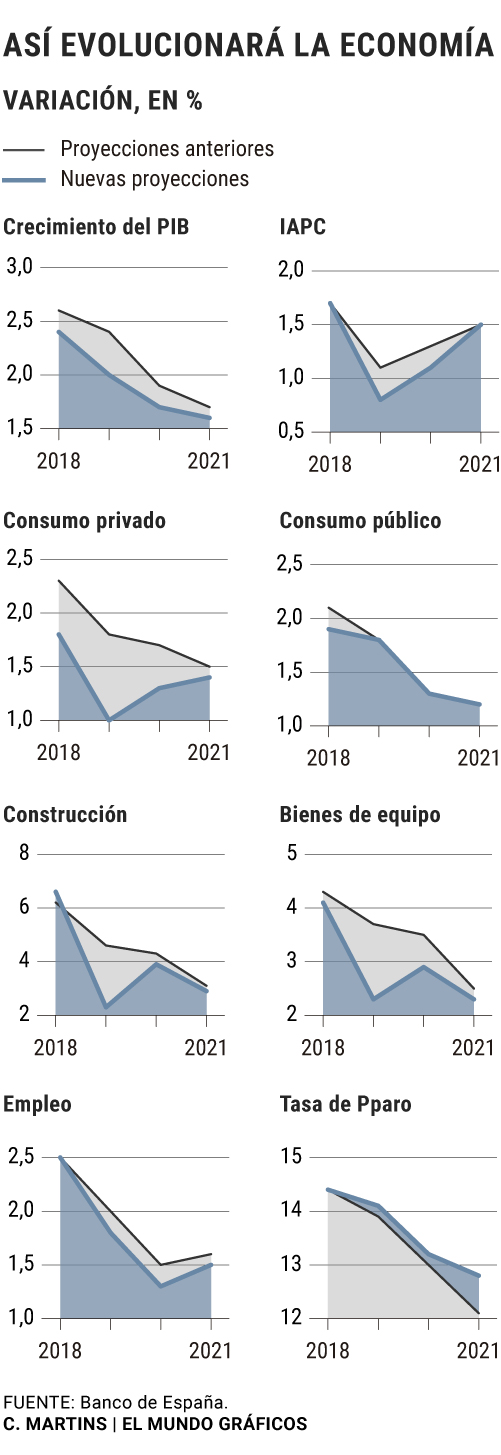

«The economic cycle in Spain has been exhausted», explains Gonzalo de Cadenas, director of macroeconomic and financial analysis of the Mapfre study service, who adds that « the activity is slowing down more than expected , something that, on the other On the other hand, it is common in the Spanish economy ». According to the figures of the Bank of Spain, the Gross Domestic Product (GDP) will grow by 2% this year, which means a downward revision of four tenths compared to its previous estimate. And, in addition, it will prevent the acting Minister of Economy, Nadia Calviño, from fulfilling her commitment to improve the official growth forecast for this year, which would have been a powerful argument in the campaign.

As factors that sharpen the slowdown, De Cadenas points out Brexit, with special emphasis on the million British tourists that Spain receives and the expenditure and investment in housing they carry out; commercial uncertainty; and internal instability, which affects decision making and investment and detracts tenths of growth.

job

The evolution of the labor market is directly related to growth, especially in the case of an economy such as the Spanish one that needs sensitive rebounds in GDP to create new jobs. «The Spanish economy is not at all as bad as, for example, that of Germany, because it is not so affected by the commercial war or Brexit. But there is an Achilles heel: Spain has to grow around 1.5% to not destroy jobs and we are approaching that limit, ”explains Juan Ramón Rallo, a doctor of economics.

The International Monetary Fund (IMF) already announced in April that the unemployment rate would hardly be reduced in the coming years and that it would stagnate around 14%. That warning was criticized by Calviño, who even pointed out that the Fund is limited to "putting some numbers in a model and seeing what results it gives" and that "it is probably not accurately reflecting what may be happening in the labor market" .

At that time, both the Bank of Spain and most of the study services supported the minister, since they considered that unemployment would be reduced. But in its latest review, the agency headed by Pablo Hernández de Cos found that, in effect, there is a strong moderation in the labor market. "Since May, the rate of job creation has been reduced by half," said the director of economics and statistics of the BdE, Oscar Arce. " The slowdown in the summer months has been somewhat more intense than we expected, " he delved into the press conference in which he presented the new projections made by his department.

These estimates indicate that the unemployment rate will be 14.1% at the end of this year, just three tenths less in 2018, and that in December 2021 it will only have been reduced to 12.8%. The figure will continue to be much higher than the data prior to the crisis, so 14 years after the start of the great recession the labor market will not have recovered. And at that time, the economy will be growing at rates of 1.6%, which means that it will be at levels close to what is estimated as the starting point for job destruction . A scenario, therefore, far away from what a president wants to present in elections in which he aspires to re-election.

'Brick' and internal demand

Two fundamental aspects for the Spanish economy and that, in both cases, are registering an important moderation. In the case of domestic demand, the Bank of Spain emphasizes that the "loss of vigor" is, once again, greater than expected. And on the construction sector, Arce stressed that «since the end of 2018, several indicators of housing investment have slowed down», with the consequent consequence on the brick's ability to pull the economy and create jobs. " The loss of dynamism is mainly reflected in the sales , which slow down at a greater intensity in the segment of the second hand," he said.

External threats

The complex international context, as noted, is already a negative factor for the economy. But, depending on how events unfold, their impact could be even greater. “It depends a lot on what Britain does with Brexit, which will be very important for exports. There is also the situation in Germany, and the war is trading, it presents very volatile episodes. We have a very complex international environment, and in that context entrepreneurs delay investments. And investment is what pulls the economy, employment, ”explains Rafael Pampillón, professor at the San Pablo CEU University and the IE Business School. «In addition, in Mexico it seems that AMLO's budgets have not liked the markets, in Brazil we have Bolsonaro and in Argentina the Kirchnerimo threatens not to face the payment of the credit granted by the IMF» he concludes.

Deficit adjustment

Faced with the slowdown, Sánchez could be tempted to present an increase in spending and deficit as an electoral promise. In fact, that was one of the recipes that the previous socialist president, José Luis Rodríguez Zapatero, applied . The problem is that, precisely as a result of those policies and the lack of adjustments by the Government of Mariano Rajoy, Spain is a "over-indebted" country, says Rallo. In his opinion, Europe could give some room to contain the deficit and allow some countries to raise spending, "but in the case of more indebted and more deficit economies," as in the case of Spain, it seems complicated. "

According to the criteria of The Trust Project

Know more- IMF

- GDP

- Nadia Calviño

- Pedro Sanchez

According to the Bank of Spain, this has been the slowdown in employment: job creation has collapsed by half since May

Economy The Bank of Spain and 16 study services believe that the State will fail to meet even the smoothed deficit target

Macroeconomic projections The Bank of Spain warns of the slowdown: growth forecast sinks and lowers job creation