- Frenazo.The price of housing falls for the first time since 2013 in Barcelona

The recovery of prices in the real estate sector since the prick of the bubble has been accompanied by a notable increase in the rental market. The consultant Knight Frank revealed on Wednesday that, although experts recommend never exceeding the 30% threshold, the rent payment is already eaten 38% of family income in Spain, far exceeding 40% in Madrid, Catalonia and the Canary Islands.

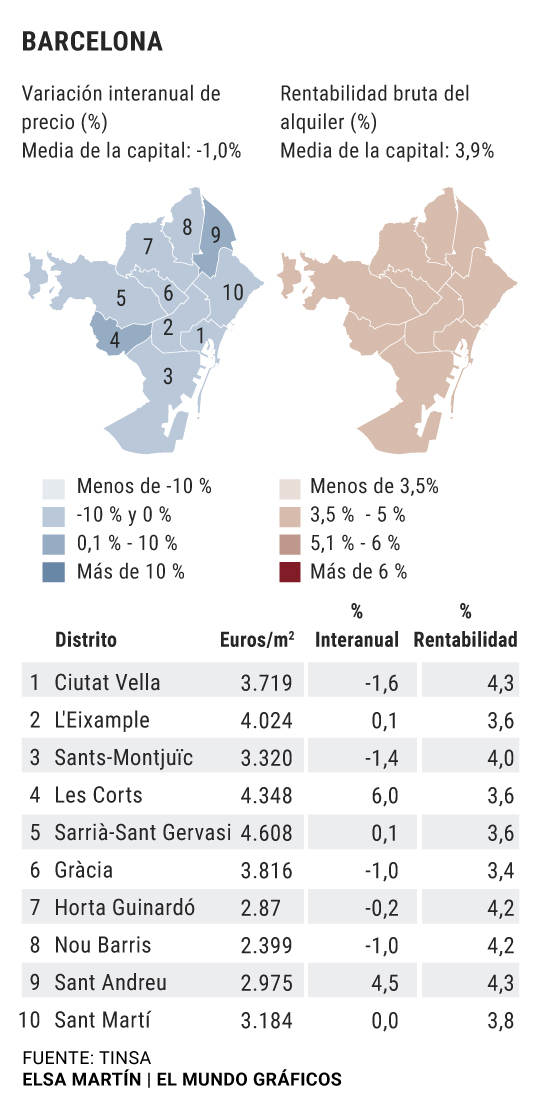

Tinsa data shows that the gross rental profitability in cities such as Madrid , Valencia or Seville is today around 4.4%, above 3.9% in Barcelona, but below the current most profitable place to rent a home: Zaragoza (4.6%).

And it is that the highest gross profitability by districts among the five major cities that Tinsa analyzes [Madrid, Barcelona, Valencia, Seville and Zaragoza] is in the Zaragoza district of Torrero-La Paz, with 5.9%; followed by Villaverde from Madrid, with 5.7% and those from San Blas and Puente de Vallecas (5.4%).

In the case of the purchase, the Spaniards allocate an average of 20.1% of their family income to the payment of the first year of mortgage, according to the data collected by Tinsa. According to the INE, the average mortgage signed in our country in the second half of the year was 122,965 euros, with an average payment of 587 euros per month.

The effort needed for that first year of mortgage is much higher in big cities. In Madrid and Barcelona it is necessary to allocate 21 and 25.9%, respectively, of the total income of each household. That of average, of course, since the effort goes through neighborhoods: clearly exceeding in the case of Madrid 25% in the districts of Moncloa-Aravaca, Salamanca, Chamberí, Chamartín and Arganzuela ; and in the case of Barcelona in Les Corts, Sarrià-Sant Gervasi (both above 30%), Ciutat Vella, Eixample and Gràcia.

Prices down in six Autonomous Communities

Prices in Barcelona have fallen this year, in year-on-year terms, for the first time since 2013 . And although in Madrid they have risen, their behavior in 2019 is also reflecting clear symptoms of exhaustion.

This is reflected in the statistics published this Friday by Tinsa, the appraisal company. According to this report, although the average price of finished housing (new and used in Spain) has increased by 3.8% year-on-year in the third quarter of the year, some significant adjustments begin to be seen.

This is the case in Barcelona , for example, where finished housing is today 1% cheaper than a year ago and is usually a good thermometer to measure the behavior of the sector. In Madrid , the other large real estate square in the country, although the year-on-year value reflects a 3% rise in price, housing has been slightly cheaper (1.7%) compared to the second quarter of the year, bringing experts They also perceive concerns.

«The evolution of the value of housing by regions ceases to compose a homogeneous map of annual cost, entering several in negative terrain. We perceive signs of depletion of the expansionary cycle, due to a weakening of the demand associated with macroeconomic cooling. A situation that could lead to future falls in demand and prices, which should not be strong except in the case of an intense economic recession, ”explains Rafael Gil, director of the Tinsa Research Department.

But Barcelona has not been the only one to see the prices of its finished properties fall. The interannual falls extend in the third quarter of the year to six autonomous communities, 19 provinces and 15 capitals, including Ceuta and Melilla.

The symptoms of braking in the market are evident, but the trend continues to rise . On average, between the third quarter and the second of the year, prices have risen by 1.2% and housing chains its twelfth consecutive quarter upward nationally. Of course, we are still very far from the years before the outbreak. Regarding the maximum values of 2007, housing still accumulates an average fall of 33.3% in Spain today.

Navarra, where it rises the most

The statistics of Tinsa allow to see the real estate behavior with a wide degree of detail, both at the regional level, by provinces, by cities and even by districts.

If we look at the photo by communities, Navarra is the one that reflects a larger increase of 6.1%, and the only Autonomous Community that shows an increase of more than 5% in the third quarter. Aragon (+ 4%), the Basque Country (3.9%) and the Valencian Community (3.9%) are the ones that, after the Regional Community, have suffered the greatest increases.

«The current trend of stagnation or even correction is manifested in the fact that 10 communities register a negative inter-quarterly variation. Only Navarra has increased the average price by more than 2% compared to the second quarter of this year, ”explains the director of the Tinsa Studies Service.

Six communities have seen this quarter reduce the price of housing compared to the same period of the previous year. Some, with notable decreases, in addition: Galicia (-5.7%), Asturias (-5.5%), Melilla (-4.7%) and Castilla León (-2.8%). In Castilla La Mancha and La Rioja, according to Tinsa, the decline has been more residual, just a few tenths but going around the trend.

The Community of Madrid and Catalonia, where prices have increased by 42% and 33%, respectively, from the lows they touched in the crisis, stand out as the most dynamic regions in recent years, far from the rest. In Extremadura , Asturias , Galicia and in both Castillas the average price has increased less than 5% from the lowest point in the crisis,

The cumulative fall since 2007 highs is still above 50% in Castilla-La Mancha (-52.8%). In La Rioja and Aragón , the gap remains at 48.6% and 45.4%, respectively. On the contrary, the Balearic Islands and the Community of Madrid leave the difference below 30% (only 19% in the case of the Balearic Islands).

If we look at the photo by districts in the main cities, it is surprising to see that six of the 10 in Barcelona already show downward trends. Also in Madrid, two of the main (and more expensive) residential districts, such as Salamanca and Chamartín, have seen their prices fall between the second and third quarters of the year. Of course, in the interannual photo they continue to show very high increases significant, of 8 and 9%, respectively.

According to the criteria of The Trust Project

Know more- Madrid

- Barcelona

- Spain

- Navarre

- Melilla

- The Rioja

- Salamanca

- Seville

- Valencia

- Saragossa

- Galicia

- Aragon

- Asturias

- Catalonia

- Madrid's community

- Basque Country

- Valencian Community

- Ceuta

- Castilla la Mancha

- Canary Islands

- living place

Politics The Government of Madrid challenges Montero and refuses to present an adjustment plan

Mortgages The collapse of the Euribor does not affect the autonomous communities: the mortgaged in Madrid and the Balearic Islands, the best unemployed

The brick clears the ghosts of braking with the largest sale of houses since 2008