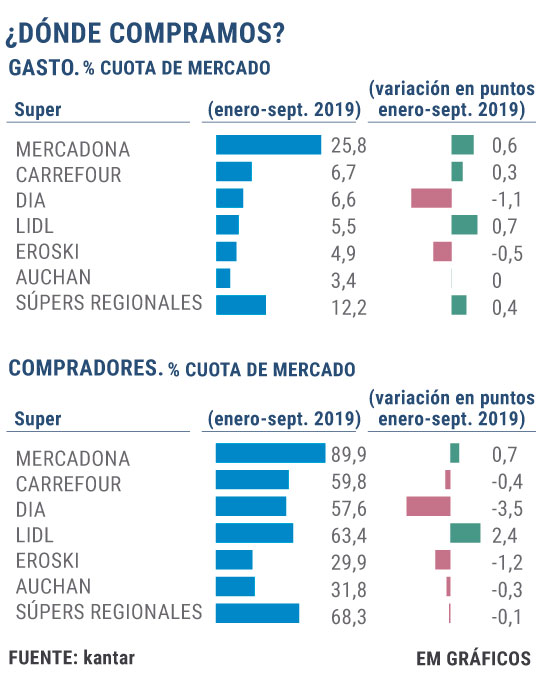

Mercadona is more leader, Dia loses share and Lidl progresses more than other competitors. The Kantar Worldpanel study presented on Wednesday shows the behavior of supermarket chains in Spain. The report analyzes what is bought, how much, at what price and also where. Mercadona is still the most visited chain , capturing 25% of the total expenditure we make on food, beverages and drugstore. It is 0.6 points more than in the same period of the previous year. One of every four euros spent on these products we leave in the boxes of the Valencian chain.

Almost 90% of consumers have ever bought or do so regularly in Mercadona. For Florencio García, distribution director of the consulting firm Kantar Worldpanel, it continues to grow "despite the size and penetration it already has." There are two reasons: the effort he is making in the category of frescoes, since he is scratching ground in areas where he is not yet a leader: Galicia and the Basque Country. In fact, its own brand is the one that sells the most in Spain. In Portugal, where they just landed this summer, they already bought or bought 11% of Portuguese, according to Kantar figures.

On the other hand is the "Lidl phenomenon" , which is the fastest growing chain, both in terms of spending and number of buyers. Four years ago I wasn't even in the top six of the chains with the most quota. Today, not only has it sneaked into the ranking, but it has been climbing positions and it is already the second chain in number of buyers (it has exceeded Carrefour and Dia) and the fourth in spending quota.

The share of Lidl is lower than that of Carrefour, the second chain of the ranking, and Dia, with a decrease of 1.1 percentage points, at a stage particularly agitated for the company, which has declared bankruptcy and has also changed Dome. Eroski has also lost share (0.5 points), and occupies the fifth position, already below Lidl.

Making a potato omelette, a typical dish of our cuisine, comes out 9% more expensive than at the beginning of the year, since the fresh ingredients we use to cook it (potatoes, eggs and onions) have become more expensive by up to 20% in the case of potatoes and 16.8% in the case of onion. This concrete example illustrates what is happening in the consumer sector, which groups all the products we buy in supermarkets, hypermarkets and specialist food stores.

The premium effect

The market is almost flat. In fact, we buy less in quantity, with a 0.6% drop in volume, but spending increases by 1% for two reasons: because we buy more expensive or premium products (what they call consumer premiumization ) and because Prices have risen, especially those of the most basic products in the basket: the fresh ones.

"There is a clear increase in consumption and expenditure on fresh products and this, in a context of stability in demand, is being the engine of large consumption and what is allowing positive numbers," said Florencio García yesterday, in the presentation of the latest study on trends in distribution and large consumption in what we have been doing in 2019.

As the expert explains, there is «clearly a price effect, we consume the same but we spend more. Product inflation is what contributes to this greater expense ». In the case of the tortilla, for example, its rise has not caused us to stop buying the products to cook it.

From January to September we have left 1.9% more money in fresh products (fruits, vegetables, meat, fish), but if we take into account the supermarket and hypermarket chains and exclude the specialized stores of a lifetime (butcher shop , greengrocer ....) we see that the expense is even greater, with a rise of 4.1% over a year ago.

This inflation of food is above the general one, which stood at 0.3% in August, partly due to the lowering of electricity.

As García explains, the consumer "increasingly bets on these chains, precisely because of the great commitment they have made to the products" that we traditionally bought in specialized stores. These (butcher, greengrocers, fishmongers) still have a 23% share, despite the fact that they are giving ground.

There are other frescoes that grow significantly, such as avocado (23%), shrimp (9.5%) or tomato, with a growth of 9%. The seafood in egernal advances 9% and the vegetables, 8.6%.

Packaged food does fall. We spend the same but we buy 1.1% less. Even so, within this category "yes there are health-related products that grow", as is the case of nuts, with an increase of 35% of expenditure, or of prepared dishes, which grow by 38%. This responds to "two booming consumption trends: concern for health and convenience or comfort," says Garcia.

According to the criteria of The Trust Project

Know more- Mercadona

- Spain

- Galicia

- Basque Country

- Portugal

According to Adecco, the average salary in Spain cuts its purchasing power by 133 euros annually since 2017

LaborWages lose bellows: the biggest increase since 2010 does not compensate ten quarters of fall in purchasing power

Savings and ConsumptionDia decides to bet on Clarel, the chain that months ago wanted to sell