- ECB: The (half-way) end of the Draghi era. And now that?

- Fortune.Ana Botín is the most powerful woman in the world

The resignation by surprise of the German Sabine Lautenschläger as a member of the board of the European Central Bank (ECB) is the last sign that the strategy of the entity to cope with the economic slowdown in the EU does not just convince, even those who have been responsible for plotting it. Since last September 12, its president, Mario Draghi , announced the new monetary policy measures for the euro zone, neither the market nor the entities nor the national regulators nor the governors themselves rely on the effectiveness of the plan.

The division within the ECB is an open secret and the resignation of Lautenschläger gives reason to the rumors. Before her, the president of the German central bank, Jens Weidmann , and that of the French, Francois Villeroy de Galhau , already made clear their opposition to relaunching an expansive cutting program. In principle, the German directive will leave its functions on October 31 , more than two years before the official end of its mandate (stipulated for January 2022). In his statement he has not pointed to any specific reason, although days before the presentation of the stimulus package he expressed his disagreement: "I am concerned about setting wrong incentives to governments if we restart the asset purchase program and acquire more sovereign bonds. it is necessary are structural reforms that foster sustainable growth, "he said then.

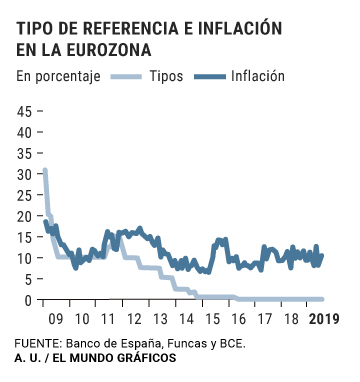

Two weeks later, Draghi presented the ECB's monetary artillery: to resume the purchase of debt at a rate of 20,000 million euros monthly in assets, postpone the increase in general interest rates sine die and reduce the ease of deposit charged to entities Its objective is to accelerate economic growth by energizing consumption and granting credit to families and businesses, but experts question it and warn of the threat of a Japanese economy in the European economy .

"Eurojaponization," Angel Berges, Federica Troiano and Fernando Rojas call it in their latest article for Funcas, which focus on the lessons to be learned from Japanese banks, as an early indicator of what the European could hold with a decade Of diference.

"After a slow digestion of the previous excesses (bubble of the 80 and first of the 90), the Japanese banking has entered a phase of positive growth, but reduced and balanced in relation to the GDP, which does not allow great joys, but neither negative surprises in the field of risk, once the adverse legacies of that historical crisis of the 80s have been digested, "the authors point out.

The main one harmed in his case is the profitability of the banks, which remains "stable but reduced, between 7% and 5%". In this regard, Funcas experts explain that monetary policy is less effective when interest rates are at reduced levels, as is currently the case.

In their analysis they ensure that, although low rates can have a positive impact - insofar as they reduce bank delinquency - the negative effect on the interest margin is greater and, therefore, the net effect on profitability is negative. In addition, the banks that save the most in the form of deposits are more affected by negative interest rates to the extent that they do not transfer them to their depositors.

The damage to profitability is one of the risks that community entities fear most. The president of Santander Bank, Ana Botín - named yesterday as the most powerful woman in the world by Fortune magazine - has just assured before a group of investors in London that the ECB measures are not working and not only because of how harmful they can result for profitability by lowering the price of credits, but because they are not favoring the whole economy or financial stability.

According to the newspaper Expansión , Botín warned this week that these measures send a signal of weak economic situation that reduces the confidence of companies and consumers, and invited investors to also express their concerns about the measures in question. Some have been doing it since the last Draghi plan was known. "The ECB measures will have limited economic success," says Esty Dwek, director of Global Market Strategy for Dynamic Solutions at Natixis IM. "Monetary policy alone cannot boost European growth," he adds.

His partner in the portfolio manager DNCA, Igor de Maack , falls in this line by ensuring that the policy promoted by Draghi "will not really revitalize the economy, much less promote a resurgence of inflation." The expert's assessment is that monetary policy has become "too complacent," with virtually a single purpose, "to save the euro" and, secondly, "to allow the poorest states to obtain funds at a very low cost." In short, what "was a great strength at the time of the Eurozone crisis in 2011, has now become a weakness."

Mario Draghi's intervention in the summer of 2012 was crucial to avoid even more serious consequences in the midst of the sovereign debt crisis that plagued several Eurozone countries, including Greece, Portugal or Spain. The Spanish risk premium at that time exceeded 600 basis points , and only when the Italian activated the purchase of national bonds, the pressure was reduced.

Corporate acquisitions were added to these acquisitions and both were maintained until last December, when monetary normalization expectations led the ECB to end its purchases. In total, the entity has allocated more than 2.5 billion euros to the purchase of public and corporate bonds in the Eurozone, and the question that analysts now ask is what room for maneuver is left for the entity to face the slowdown Economic in the Old Continent.

Draghi ends his term on October 31 and it will be Christine Lagarde, until now at the head of the International Monetary Fund (IMF) who will take the witness. The French will find figures that already show the stagnation of the regional economy, affected by the possible recession in Germany, the impact of the trade war between the United States and China, difficulties in agreeing to Brexit or geopolitical risks in countries such as Italy.

The OECD has already warned this week that the scope of the European Central Bank in this context will be limited, "particularly in more advanced economies." "Monetary policy has done a lot, but it cannot offer a solution for everything and it is not normal for it to do it alone," admitted the institution's chief economist, Laurence Boone.

Experts begin to emphasize that it is time to give more weight to fiscal policy to try to boost growth.

Sylvain Broyer, EMEA chief economist at the S&P rating agency predicts another 10 basis point rate cut in December, "as lower economic growth in Europe seems inevitable."

According to the criteria of The Trust Project

Know more- European Central Bank

- Mario Draghi

- Christine Lagarde

Macroeconomics Draghi fires his last bullet: he sinks the deposit rate further and will buy another 20,000 million bonds since November

Appears before ParliamentLagarde reiterates that an expansive policy "is necessary for a prolonged period"

EconomyBrussels raise pressure on Germany to increase spending and investment