On Wednesday, September 11, world oil prices are steadily rising during global trading. The raw materials of the Brent benchmark rose almost 1.2% to $ 63.1 per barrel. Such data are provided by the ICE exchange in London.

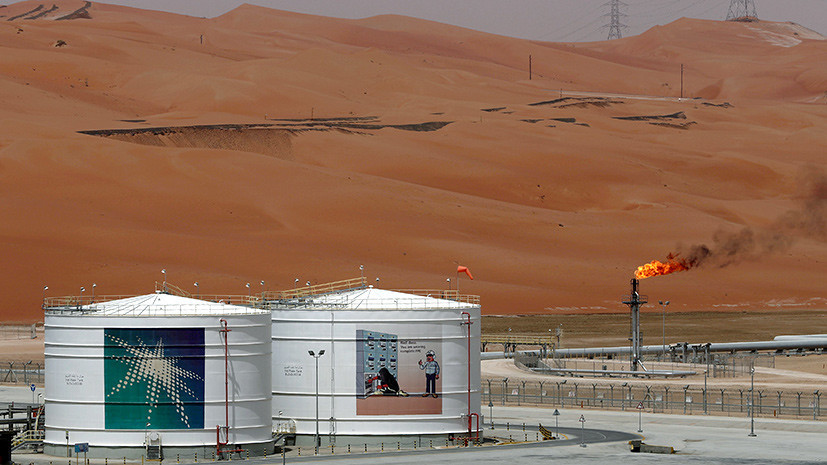

According to experts, the markets reacted positively to the statement of the head of the largest oil company in the world, Saudi Aramco, Amin Nasser. According to him, Saudi Arabia’s state-owned corporation may enter the global stock market already “in the near future,” the Arab News newspaper reported.

The first public offering (IPO) of the commodity giant may be the largest ever. In total, the kingdom plans to sell 5% of Saudi Aramco's securities and raise $ 100 billion. As Amin Nasser noted, the IPO of Saudi Aramco will be held on the Saudi Tadawul exchange, and later the company will be ready to go to foreign markets.

As previously stated by the Crown Prince of Saudi Arabia, Mohammed bin Salman, the total cost of the state corporation is estimated at $ 2 trillion. This value is more than double that of the most expensive companies in the global stock market. For comparison: today the market value of Microsoft is $ 1.03 trillion, Apple - $ 979 billion, Amazon - $ 900 billion, Alphabet (owned by Google Inc.) - $ 836 billion. Such data are quoted by the NASDAQ.

Note that back in 2017, the world's largest stock exchanges began to fight for the right to become a platform for the IPO Saudi Aramco. For example, Donald Trump called on Saudi Arabia to place the company's shares in New York. At the same time, the UK government actively promoted the idea of listing in London and provided the Saudis with a $ 2 billion credit guarantee.

For the first time, the IPO Saudi Aramco idea was proposed in 2016 and became one of the main points of the Saudi Arabia reform program “Vision 2030”. The strategy is aimed at changing the structure of the economy and reducing the kingdom's dependence on oil. As the chief analyst of BCS Premier Anton Pokatovich explained in an interview with RT, the implementation of the plans requires large budgetary injections. A significant part of these funds is going to be raised by the authorities through the sale of shares in Saudi Aramco.

According to Pokatovich, for the company to successfully enter the Saudi Arabian stock exchange, high oil prices are needed. Meanwhile, over the past year, a barrel of Brent energy has fallen in price by almost $ 20. Thus, markets expect the kingdom to try to create more suitable conditions in the energy market before the planned IPO.

“Investors took the announcement of an imminent IPO as a signal that Riyadh would take all efforts in the near future to ensure the necessary level of oil prices for the company to go public. Note that this signal was taken by the market with particular seriousness, since the kingdom has undergone significant changes in the structure of "oil power", the expert noted.

In early September, after three years of work, Khaled al-Faleh resigned as head of the Saudi Ministry of Energy. Moreover, the ex-minister also resigned as chairman of the board of directors of Saudi Aramco.

According to the royal decree, the former head of the Ministry of Energy appointed former assistant to Faleh, Prince Abdel-Aziz bin Salman. According to analysts, as a result of political changes, the kingdom may begin to further reduce oil production under the OPEC + deal. The country's actions will further reduce the supply of hydrocarbons in the world, and energy prices will begin to grow faster.

“In professional circles, the new Minister of Energy is known for repeatedly seeking to increase oil prices in difficult circumstances. Now this is the situation. Due to trade wars and a slowdown in the global economy, oil prices are already at risk this fall to $ 50–55 per barrel of Brent. This is completely unacceptable for the economy and future plans for the development of the kingdom, ”Bykov added.

As the expert explained, most of the countries participating in the OPEC + deal are comfortable with oil prices near $ 60 per barrel. However, the budget of Saudi Arabia can get out of deficit only with quotes above $ 80. Thus, the analyst believes that it is beneficial for the kingdom to pursue an even more aggressive policy to reduce oil production.

Earlier, the ex-Minister of Energy of Saudi Arabia Khaled al-Faleh said that the IPO Saudi Aramco can be held only in 2020-2021. According to Anton Bykov, up to this point, the country's authorities can deliberately foster the interest of market players and thereby influence the growth of quotations.

“Saudi authorities can use the Saudi Aramco IPO as a bargaining chip to influence oil prices. With the same ease, this topic can again go on indefinitely. Therefore, until the exact date of the placement of shares is announced, the IPO Saudi Aramco should be regarded as a tactical move than a highly probable event, ”concluded Bykov.