- G-7.Trump tries to reduce the tension of the commercial war

In full slowdown of the world economy , countries seek to have a less strong currency to try to stretch growth as much as possible over time. It could be another economic strategy, but in recent months it has become one of the keys that underlies the US and Chinese trade war and is threatening the end of the global cycle.

Both countries raised the tension of the conflict at the end of last week. First, China announced new tariffs for US products worth 75 billion dollars and then Donald Trump responded by tightening the tone and measures against the Asian giant. It happened last Friday and Wall Street welcomed both movements with significant losses.

Yesterday, everything presaged a new black Monday in the stock markets around the world, but the situation returned to take a turn of script and both powers decided to lower the tone of the climb. "China called our sales managers last night and asked to return to the table ... It is a very positive event for everyone," Trump announced in statements collected by the Efe agency at the G7 summit that these meetings have been held. days in Biarritz (France). Steps like this show "why Xi Jinping is a great leader," since "he understands how things work," he added.

Beijing, for its part, was in favor of a "quiet" resolution of the trade war through dialogue and negotiation, according to the Deputy Prime Minister of the Asian giant, Liu He , during his speech at the Smart China Expo in Chongquing.

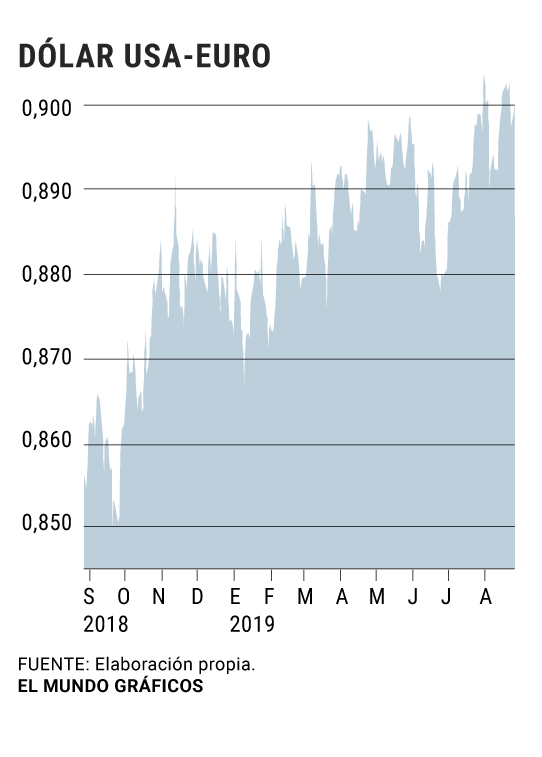

Before the declarations of one president and another, the price of the yuan against the dollar sank again until reaching a change of 7.14 per dollar, its lowest level since the beginning of February 2008. The devaluation of the currency has been the a tool that China has used lately to offset tariffs imposed from Washington. In fact, just two weeks ago, the Government of the country allowed it to lower for the first time the psychological barrier of the seven yuan for each greenback .

A cheaper yuan means that the products and services that China exports are also cheaper, raising the competitiveness of its companies and thus offsetting tariffs than the US. On the opposite side, it makes imports more expensive and reduces the value of the assets of foreign investors, which can lead to a massive capital outflow. Beijing has to measure the steps in this direction very well.

Each depreciation of China causes a risk aversion movement; Investors flee and take refuge in assets and currencies that they consider safer and more attractive, such as the dollar, and this current pushes the dollar up, just the opposite of what Trump is pursuing.

That is why the tone of the American president was more relaxed yesterday. It is part of its strategy: to give one of lime and one of sand to modulate the impact of the trade war and continue to pressure the Fed to lower interest rates. "It's the way that business is very good for me and even better for the country," he said yesterday, noting that someone should have defended the US position many years ago.

Currency war

Can you talk about currency war? For Ignacio Perea , investment director of Tressis, "it exists covertly and the commercial war is only an excuse to formalize it."

In its analysis, Europe also participates in that war, since the new measures that the ECB is considering "will cause the euro to weaken against the dollar."

Back to the beginning, countries seek to have a less strong currency, the problem is that they do it all at once. In the current scenario, depreciation of currencies such as the euro or the yuan is taking place at the cost of the dollar, which is precisely the opposite of what Trump is pursuing.

The US president has openly lamented the strength of the dollar and the threat it poses to its economic agenda. It is not casual. A weak dollar would make it possible to extend the good moment of the US economy and give the Republican leader one more argument for his 2020 presidential candidacy, the true objective of his trade crusade against the world.

China could tighten its exchange position a little more, "but it does not have much margin, because a greater devaluation of the yuan would take its economy ahead and could lead to the flight of capital from the country," Perea reflects.

For George Efstathopoulos , co-manager of the Fidelity Global Multi Asset Income Fund, "the outlook for a currency war between the US and China is worrisome and its odds have increased," although it is not his main working hypothesis.

Nor is that of Stéphane Monier, Investment Director of Lombard Odier, which highlights "the need for caution" in this regard.

According to the criteria of The Trust Project

Know more- China

- Donald Trump

- Markets

Trade war The Ibex 35 falls 0.6% in the opening after the trade war between the US and China intensifies

Macroeconomics The devaluation of the yuan plunges Wall Street and the United States calls China "manipulator"

Macroeconomics Conflict with the US slows China's international trade