- Finance: Three million Spaniards will not have access to cash in just five years

Being a saver and not losing money in the attempt has become almost a taxable mission for millions of Spanish homes. After five consecutive years of GDP improvement and reduction in the unemployment rate, the balance accumulated today in cash and deposits by families in their respective financial entities has soared to 869,000 million euros, the largest record in the historical series that publishes the Bank of Spain. But now the most difficult thing comes: to get performance at that figure or, at least, prevent it from burning day by day at the rate set by the interventionist central banks and inflation.

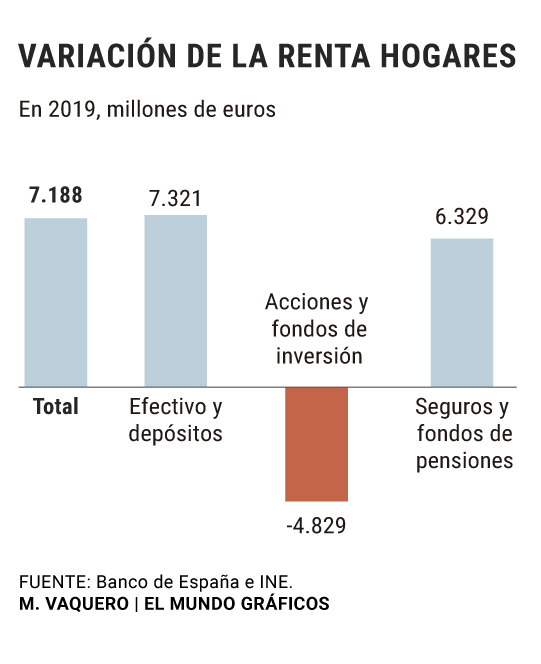

In the last year alone, the increase in liquid savings in the household bank was 35,000 million euros. If it is divided by the 18.6 million families in Spain at the end of 2018, the increase in savings saved in the bank would be 1,891 euros per home. This is the largest increase since 2008, when families decided to flee from the financial markets and take refuge in their current account to alleviate as much as possible the collapse of the world stock exchanges that brought the great recession.

The difference with then is that today the most conservative savings are heavily penalized by the intervention of central banks . 11 years ago a Spaniard could buy 12-month Treasury bills to protect himself from the financial storm and obtain a return of more than 4% in return. On August 13, the investor who bet on this same product had to pay 0.5% to park his money in the coffers of the State.

The same happened with bank deposits: in 2008, financial institutions gave their clients a return of up to 5% per year for capturing their savings for one year, while now many entities have removed this product from their financial catalog and others maintain it. with an average interest of 0.03% per year. For now, the banks have rejected fully that this interest also goes into negative and they begin to charge their clients to guard their savings - as they already do with large companies and investors - as a measure to mitigate the impact of cheap money on their financial accounts .

And the stock exchanges, meanwhile, live weighed down by the multiple fronts of uncertainty open globally (trade war between the US and China, Brexit, political paralysis in Spain and Italy, financial worsening of Argentina ...) with extreme volatility. In the last month alone, the Ibex has lost more than 6.5% of its value, leaving almost zero earnings accumulated in the year.

The epicenter of this huge financial earthquake takes us back to the German city of Frankfurt on March 16, 2016, just at the moment when a European Central Bank (ECB) already led by Draghi announced the historic reduction of interest rates in the Euro zone up to 0% with the aim of stimulating the economy and easing the financial bill of the indebted European countries.

Three years later the Draghi plan has lost all of its bellows: EU countries continue to carry a heavy financial burden - the GDP debt ratio in Spain, for example, remains at 98.3% of GDP - and the ghosts of the Recession are more alive than ever . It is for this reason that more and more analysts point to the fact that in September the ECB will launch a new stimulus program, which will be the final big traffic as a farewell to the Italian banker before transferring the position in October to the outgoing Director of the Fund International Monetary (IMF), Christine Lagarde.

And if this happens, the Spanish saver will suffer again. "By reducing interest rates and making it less attractive to save and more attractive to ask for credit, the central bank is encouraging citizens to spend money or invest," they explain at the institution.

In Spain it seems that the measure has taken effect. The family savings rate remains at 4.9%, the lowest level in the historical series. That is to say, of every 100 euros that enter the house only 4.9 are saved, while the rest is mainly destined to reduce debts and buy those durable consumer goods - cars, appliances ... - that had been postponed over the years hardest of the crisis.

In front, as almost always, the Germans, with a record saving rate in the opposite direction of 18%. Why? The first because the remuneration of employees in this country - where the unemployment rate is at historically low levels of 3.1% - grows at a faster rate than that of Spain. And the second because the Germans have put the brake on their consumption, especially in the powerful industrial sector of the automobile. This slowdown - less consumption and, therefore, less investment - has already resulted in the paralysis of the German economy and its foreseeable entry into recession this same quarter.

"The reason for precaution is also an important factor for saving, especially in contexts of uncertainty, which leads households to constitute financial cushions to which to resort to unforeseen expenses or unexpected falls in income," explained Ana del Río and José Antonio Cuenca, from the Bank of Spain. Both analysts place among these concerns "the economic slowdown, the volatility of global financial markets or political uncertainty, and in particular about fiscal policy in some countries." That is to say, what is happening in Spain is now happening in Spain between 2008 and 2013 .

If the savers are the big ones harmed by the hyperstimulated monetary policy of the central banks, the big beneficiaries of this rent transfer are the indebted ones. The foreseeable rate reduction and the purchase of debt by the ECB will further deepen the reduction of negative interest in Europe, which will benefit states like Spain - which has already reduced the average interest rate of its debt to 2, 32% since 4% of 2011, around 20,000 million a year-, companies and households with mortgages and other consumer loans whose interest rates are not fixed.

The other big beneficiaries will be investors, especially companies that will see their growth cheaper. On a financial level, the new stimulus program could encourage global exchanges if it meets the increasingly voracious expectations of investors and, above all, if it is effective for the purpose it is designed to: boost the global economy and clear the threat of a negative growth in the Old Continent.

According to the criteria of The Trust Project

Know more- Spain

- GDP

- IMF

- Bank of Spain

- Italy

- Europe

- Christine Lagarde

- China

- Argentina

- Germany

Frenazo Countries prepare for the coming recession ... less Spain

EconomyMore 'doping' from Frankfurt against the economic brake in Europe

BolsaChina reactivates the commercial war, knocks out the Ibex and plummets the interest of the Spanish bond to the historical minimum