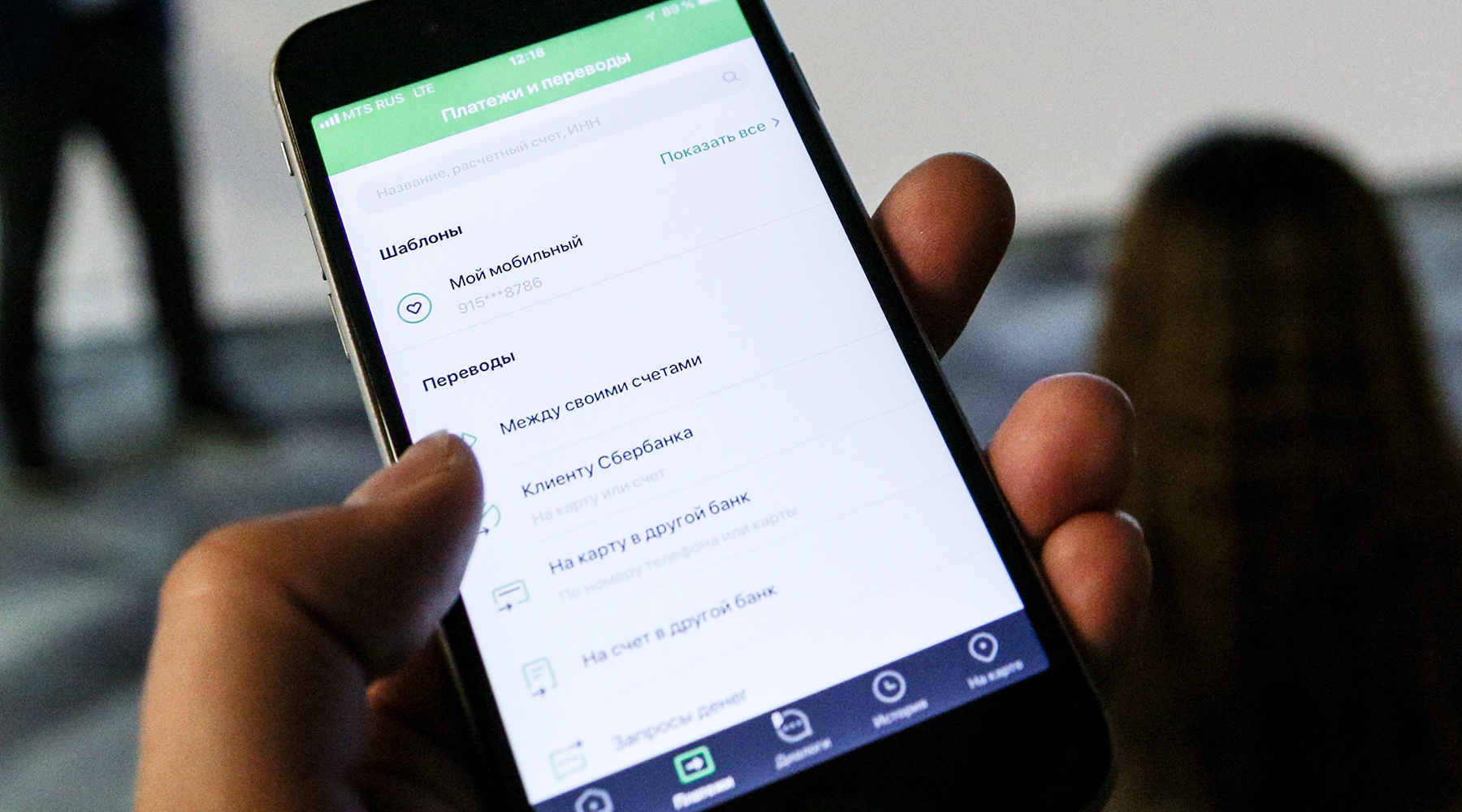

Sberbank of Russia has canceled free SMS and push notifications for transfers to debit cards. According to RIA Novosti, now these notifications are included in the paid service package.

"You will only receive passwords and codes for registration in Sberbank Online and payment on the site," the Sberbank call center said.

Thus, holders of debit cards to receive information about transactions must connect the paid service "Mobile Bank", which costs 60 rubles per month. However, credit card holders will continue to receive appropriate notifications.

According to RBC, depending on the region of Russia, the changes took effect at the end of July - at the beginning of August.

Viktor Dostov, Chairman of the Electronic Money Association, Chief Researcher at St. Petersburg University, noted that some time ago the Central Bank was puzzled by the issues of tariff regulation of the commission, in particular, banned roaming. According to him, in order not to break the law, Sberbank began to introduce various subscriptions.

“It was a pretty predictable situation ... What we see is the next step. Sberbank needs to take money from somewhere to maintain its system, it takes it in a way that is not prohibited by law, namely, by connecting paid notifications. If we hypothetically assume that the next law will prohibit paid notifications, they will be free, apparently, they will think something else - that is, introduce or increase a monthly fee for cards, or some kind of fee for using online banking or for something- then something else, "- said Dostov RT.

According to him, the cancellation of notifications on transfers to debit cards will affect the vast majority of the bank's customers.

“If at one time only people who transferred money from one region to another paid money, now this is a uniform commission that we will all pay. Of course, you can refuse notifications, but this is very inconvenient, and I do not think that anyone would start doing this in large numbers, ”Dostov explained.

Recall that since June 2, Sberbank introduced a commission for internal money transfers through self-service devices. Now for the transfer of any amount through an ATM, customers have to pay 1%, but the commission cannot exceed 1,000 rubles, regardless of the region.

“This monthly limit meets the needs of almost 90% of Sberbank's clients,” the press service of the credit and financial institution reported.

According to the new system, customers can transfer up to 50 thousand rubles a month for free, and then either purchase a subscription to make interest-free transfers, or pay 1% from each transaction. At the same time, the limit does not apply to ATM transfers.

- AGN "Moscow"

- © Kirill Zykov

Svetlana Kirsanova, deputy chairman of the board of Sberbank, explained that the introduction of paid subscriptions is due to the need to receive funds for the development of the organization.

“We need basic investments in its further development, including to improve reliability and stability. Therefore, the commissions will be aimed at maintaining the infrastructure, technical support, building infrastructure and operational processes, ”she said.

Such steps were taken by Sberbank after the adoption of the law on the abolition of the so-called bank roaming, which implies the elimination of commission for money transfers between clients from different regions of the country. The corresponding bill was submitted to the State Duma in September 2019. As follows from the document, the size of the commission charged when transferring funds between accounts of individuals within one bank cannot be due to the opening of accounts in different structural divisions of a credit institution.

The parliamentarians pointed out that the adopted changes should ensure the development of non-cash payments and protect the interests of citizens.

As the chairman of Sberbank German Gref pointed out, as of October 2019, 95% of all bank transfers are made free of charge.

“We are now changing the monetization model, next year (in 2020 - RT ) we will definitely change it. When we connect to the fast payment system (now the process is underway, in fact), this system will be implemented. Therefore, we delayed the change in the monetization model a little. We needed to change the monetization model earlier. We only started in April to carry out various experiments in order to understand what will be adequate, what will be perceived by the client, ”he said.

In December, Russian President Vladimir Putin signed a law abolishing bank roaming. The document entered into force on June 14, 2020.