For the month of the program of preferential lending at 2% per annum, Russian banks approved 134 thousand loans worth 315.6 billion rubles to the business. This is stated in a statement published on Tuesday, July 7 by the Ministry of Economic Development.

Recall, from June 1, companies and entrepreneurs affected by the coronavirus pandemic can apply for a loan at a reduced rate for the resumption of activities. The business should use the money received to pay salaries to staff at the rate of one minimum wage (12,130 rubles) per employee.

The loan provided to companies is 85% secured by state guarantees. The loan itself can be partially or completely written off if employers retain jobs.

Note that initially under the program, the total amount of all loans issued to business should not exceed 248 billion rubles. Meanwhile, experts say that the provision of soft loans has become one of the most popular measures of direct assistance to companies from the state. Against this background, the government has doubled the program limit - first to 352 billion rubles, and then to 468 billion.

“Given the shortage of working capital, it is extremely important for employers to retain staff, which is why state money allowed enterprises to survive difficult times. Given the fact that companies are just starting to recover, loans will be of great help and will help save some business representatives from bankruptcy, ”said Pavel Sigal, vice president of the Russian public organization for small and medium-sized enterprises“ Support of Russia ”.

The most demanded preferential loans were among companies in the services sector, leisure and entertainment, tourism, as well as hotel business. This was stated in an interview with RT by investment strategist of BCS Premier Alexander Bakhtin.

“The pandemic has had a dramatic impact on these companies, as they are still either completely closed or operating in a restricted mode. Non-food retail and catering enterprises were less affected, but they would also be in a difficult situation without a credit line from the state, ”Bakhtin explained.

According to the Ministry of Economic Development, the soft loan program can support more than 3 million jobs.

- RIA News

- © Alexey Sukhorukov

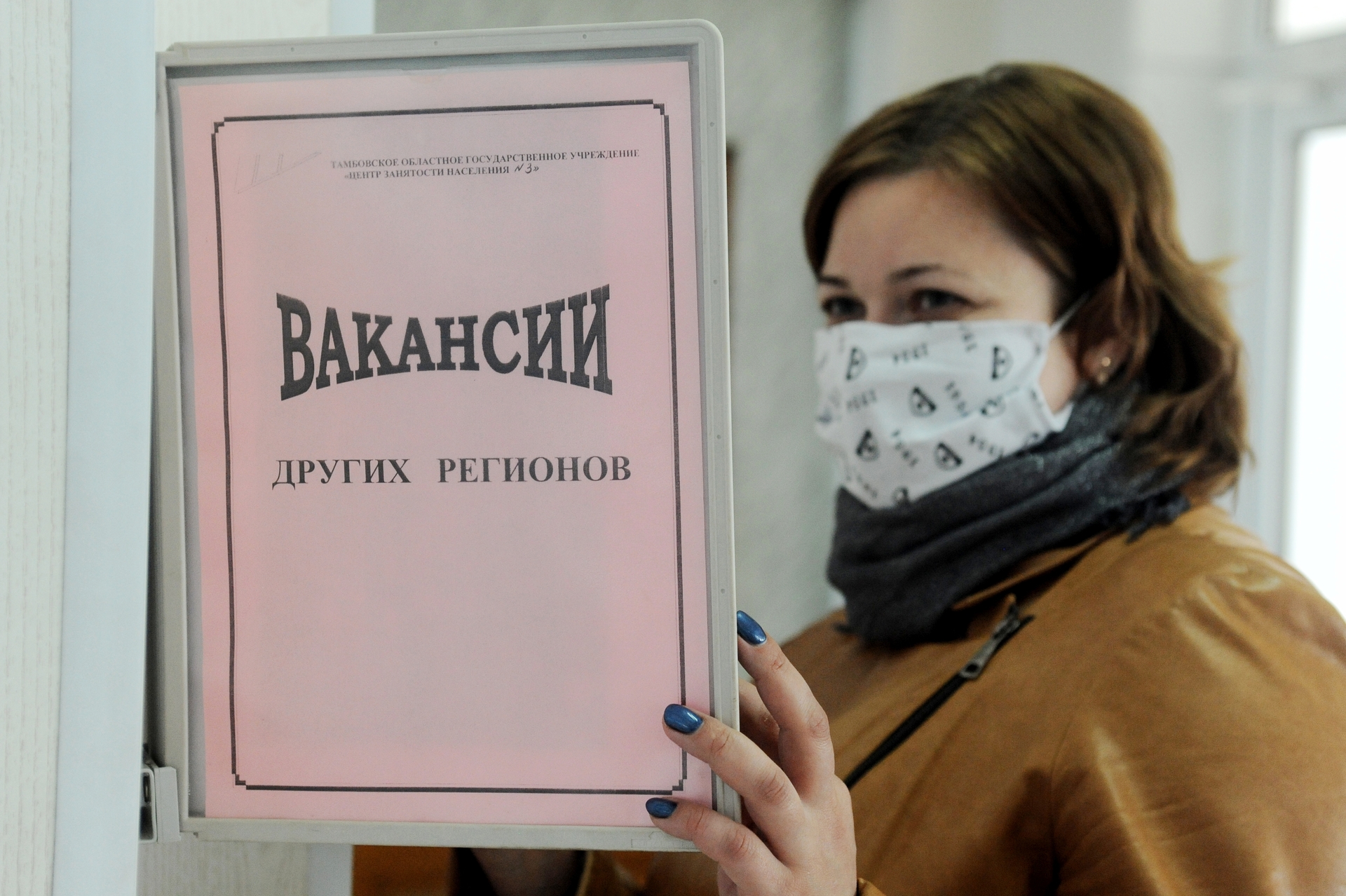

Recall, according to the Federal State Statistics Service, in March the unemployment rate in Russia was about 4.7%, however, as a result of the pandemic following the results of May, the value increased to 6.1%. According to experts, a possible extension of the issuance of loans at a reduced rate to business will help stabilize the situation in the employment sector faster.

“The company can count on a full write-off of the loan, provided that employment is maintained at 90%. This state of affairs encourages businesses to retain their staff as much as possible and at the same time protects the labor market from increasing the share of shadow employment. As a result, such a measure of business support can significantly reduce the unemployment rate to 5.5–5.7% already in the first quarter of next year, ”said Georgy Ostapkovich, director of the Center for Market Research at the Institute for Statistical Studies and Economics of Knowledge, Higher School of Economics.

The stabilization of the labor market should lead to an increase in the purchasing activity of Russians and thereby stimulate consumer demand, which has sunk in recent months. This point of view in an interview with RT was expressed by the director of market analytics of the resource podelu.ru Liliya Fedulina.

“Saving jobs can be one of the key drivers of boosting consumer demand in the country. Russians with stable employment are not afraid to spend money on everyday needs and entertainment. Due to the growth of domestic consumption, virtually all sectors of the economy are developing, which has a positive effect on GDP, ”Fedulina emphasized.

According to the forecast of the Central Bank, in 2020, Russia's GDP may decline by 4-6%. As Georgy Ostapkovich believes, already in 2021 the economy will show compensating growth within 2.5%. At the same time, over the next few years, the authorities will continue to provide assistance to the business affected by the coronavirus, the expert said.

“The reserves accumulated by the state allow supporting the business for several more years. Therefore, the government will continue to provide assistance to enterprises whose restoration will ensure the growth of production capacities in the light and heavy industries. As a result, the invested money will give a certain impetus for the operational restart of the economy, ”concluded Ostapkovich.