Private financial institution Rapidly responding to cash flow support New Corona April 19 6:54

The number of applications for the government's financing support measures for small and medium-sized enterprises affected by the new coronavirus has rapidly increased, and it often takes longer to lend. In order to connect funds during that period, private financial institutions have begun to make decisions on loans within the same day if they receive an application.

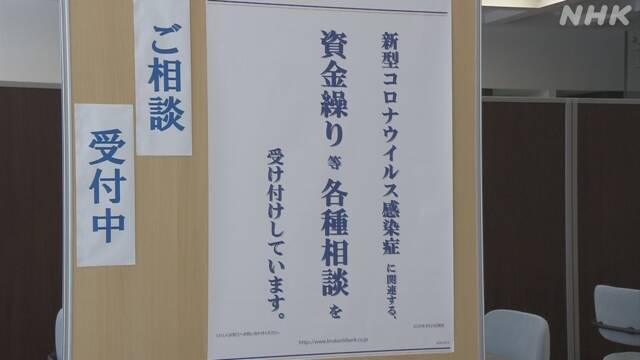

Kiraboshi Bank, a regional bank headquartered in Tokyo, has created a unique mechanism to support the financing of companies affected by the spread of infection.

The feature is that the branch decides whether to lend or not, without the examination of the head office. For companies that have transactions from before, if it is early, the loan will be decided on the day you apply. New customers will also make a loan decision within 3 business days. Banks also want to act as a bridge until the government's financing support financing is decided.

Nobuto Watanabe says, “So far, companies that are working hard with their own funds are feeling uncertain about the future and are increasing the number of consultations day by day. I want to firmly protect the local economy.”

In addition, Shiba Shinkin Bank in Tokyo has also created a fund that can be immediately loaned at the discretion of the branch manager, and there is a growing movement to respond quickly to support cash flow.

In addition, when the Fukuoka Bank of Fukuoka Prefecture receives a consultation from a company that it wants to change the borrowing conditions, it will postpone the repayment for about three months, and in the meantime, it will start efforts to work with the company on various measures at private financial institutions. The correspondence has begun.