Real estate market prices in 70 large and medium-sized cities rose

slightly Data released by the National Bureau of Statistics in March showed that housing demand due to the epidemic situation was gradually released, and housing prices were generally stable

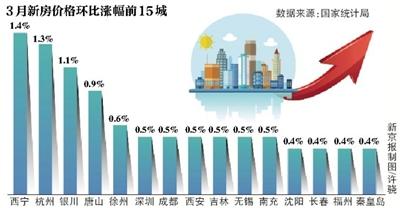

Data released by the National Bureau of Statistics on April 16 showed that the prices of real estate markets in 70 large and medium-sized cities rose slightly in March. Among them, the number of cities with new homes rose in March to 38 from 21 in February, and the prices of new homes in Xining and Hangzhou rose by 1.4% and 1.3% respectively, leading other cities across the country. The number of cities where second-hand housing rose in March rose to 32 from 14 in February. Shenzhen's second-hand housing price increase ranked the first in the country after two years, with an increase of 1.6%.

According to the National Bureau of Statistics, housing prices rose slightly in March because the backlog of housing demand showed a gradual release, but overall it was relatively stable. In the industry's view, the current market performance is far from overheating or heating up. It is expected that both supply and demand will be released in the second quarter, and the overall housing prices will still be "stable".

Under the epidemic, will the economy be under pressure, and will the relevant policies of the real estate industry as the main easing stimulus in the counter-cyclical adjustment change? Industry insiders analyze that it is expected that there will be more regions to optimize the regulation policy in the future, but it will not "open up", and it is difficult for housing companies to supervise their policies greatly.

New houses rose to 38 cities in March

According to the house price index data calculated by E-House Research Institute, from the number of cities with rising and falling house prices, the number of cities with rising house prices is 38, which is a significant increase compared with 21 in February. The number of flat cities was reduced to 10.

Among them, the sales price of newly built commercial housing in four first-tier cities increased from 0.2% month-on-month to an increase of 0.2%, but the increase was 0.2 percentage points lower than that in January. Beijing was flat, Shanghai and Shenzhen rose 0.1% and 0.5% respectively, and Guangzhou fell 0.5%.

The sales price of newly built commercial housing in 31 second-tier cities rose by 0.3% month-on-month, an increase of 0.2 percentage points from the previous month, and an increase of 0.1 percentage points from January; the sales price of newly built commercial housing in 35 third-tier cities rose by 0.2% from the previous month, an increase from the previous month 0.1 percentage points, down 0.2 percentage points from January.

"In March this year, the property market performed better than expected, and some cities even appeared to be robbing houses, so house prices in some cities did not show significant price reductions, which also caused a certain increase in chain growth compared with February." Yiju Yan Yuejin, Research Director of the Think Tank Center of the Academy said.

Judging from the increase in specific cities, Xining led the nation's 70 cities with new house price increases with a 1.4% increase.

Why does Xining's new house price increase rank first in the country? Yan Yuejin believes that the real estate policy in Xining area itself is relatively loose. In the past few years, housing prices in the area have been relatively stable. The current rise in housing prices has the property of compensating the increase.

According to data from the National Bureau of Statistics, in March, the sales price of newly built commercial housing in first-tier cities increased by 3.3% year-on-year; the sales price of second-hand housing increased by 2.4% year-on-year. The sales prices of newly built commercial housing and second-hand housing in second-tier cities rose by 5.8% and 2.5% year-on-year, respectively, and the growth rates fell for 11 consecutive months. The sales prices of newly built commercial housing and second-hand housing in third-tier cities rose by 5.3% and 2.8% respectively year-on-year, both of which remained the same or fell for 12 consecutive months.

Shenzhen's second-hand housing rose again ranked first in the country

According to the house price index data calculated by the E-House Research Institute, the sales price index of second-hand housing in 70 cities in China rose by 0.0% month-on-month and 2.7% year-on-year in March. Among them, the chain-on-month increase has expanded, while the year-on-year increase has narrowed. Judging from the number of cities rising and falling, the number of second-hand housing rose in the 70 cities in March was 32, showing a significant increase compared with 14 in February.

"In February, the market was significantly affected by the New Coronary Pneumonia epidemic. Since March, the market has recovered, even better than expected. This will also cause a rebound in the prices of second-hand housing in many cities. The number of cities with rising housing prices has It has something to do with the rhythm of starting and resuming work, "said Yan Yuejin of Yiju Research Institute.

Beijing, Shanghai and Shenzhen's second-hand residential sales prices rose by 0.2%, 0.3% and 1.6% month-on-month, and Guangzhou fell by 0.2%. In 31 second-tier cities, second-hand residential sales prices rose 0.2% month-on-month after flat for two consecutive months. The sales price of second-hand residential properties in 35 third-tier cities changed from a decrease of 0.1% last month to an increase of 0.1%, a decrease of 0.1 percentage points from January.

In March, Shenzhen's second-hand housing prices rose first in the country, up 1.6% month-on-month. In February 2018, Shenzhen's second-hand house price index rose the first in the country, that is to say, after a lapse of 24 months, Shenzhen's second-hand house price increase returned to the first place in the country.

Focus 1

The prevention and control situation is heating up towards the property market?

In March, prices in first- and second-tier cities generally rose slightly. How do you view this phenomenon? Kong Peng, chief statistician of the City Department of the National Bureau of Statistics, said that in March, as the prevention and control situation of the new coronary pneumonia epidemic continued to improve, the production and living order accelerated, the housing demand due to the backlog of the epidemic showed a gradual release, 70 large The price of the urban real estate market rose slightly, but overall it was relatively stable.

According to Zhang Dawei, the chief analyst of Zhongyuan Real Estate, a number of factors led to the rise in housing prices in March. "First of all, it is related to the lag of statistical data. Most of the second-hand housing transactions are also intentional transactions before the epidemic. However, it was not until the middle and late March that the country gradually began to open the sales office and the second-hand housing to see the house. ; Secondly, expectations of interest rate cuts, etc. have also led to a gradual recovery of the market. But overall, the increase in house prices in March is still the reason for sampling in statistical data. "

"There are indeed hot-selling real estate in some areas of the market today, and the number of house watchers has increased significantly compared to before, but it is far from overheating or heating up. The market is expected to continue to recover under the expectations of interest rate cuts, etc. It is likely to be close to returning to the 2019 average. "Zhang Dawei said.

According to Xie Rui, a senior analyst in the Oriental Jincheng real estate industry, as the cities continue to resume work in the second quarter, supply and demand will be released in a concentrated manner, and the overall housing prices will still be "stable". "However, there is a regional differentiation in the amount of demand replenishment and housing prices. The sales of first-tier and core second- and third-tier cities under the support of industry and population will be repaired to a certain extent. Third- and fourth-tier cities in regions with severe demand and epidemic conditions are facing greater sales pressure. "

Focus 2

Will the real estate policy be liberalized?

Under the impact of the epidemic at home and abroad, China's economy is under significant pressure. The real estate industry, which has been the main driver of easing stimulus in previous counter-cyclical adjustments, has been the focus of recent market attention. According to Zhang Dawei's statistics, in March alone, nearly 20 cities across the country issued various talent policies, most of which were related to house purchases. However, Zhumadian, Guangzhou, Baoji, Jinan, Haining and other cities have all withdrawn policies shortly after they introduced policies concerning purchase restrictions and loan restrictions.

"The policies issued by these local governments have been withdrawn, fully reflecting that the policy focus will not alleviate the pressure on housing companies through measures such as massive leverage, stimulating demand for housing purchases that violate the" three stability "expectations. There is greater pressure, and it is expected that there will be more regional optimization and control policies in the future, emphasizing policy assistance to housing companies. Real estate policies have a high probability of remaining marginally loose, but they will not "open up". In the medium- and long-term, strict control of the red line of housing and housing is difficult, and it is difficult for housing companies to supervise their policies.

Zhang Dawei holds a similar view. "From the perspective of market stability, local governments should never violate the principle of housing and housing, not to speculate, but to introduce some policies for stabilizing and realizing self-occupancy just to avoid the possibility of a break in the capital chain of some real estate companies from April to May."

Beijing News reporter Hou Runfang