- Courts: A judge obliges Santander to return 500,000 euros to a taxi driver and his wife for the subordinated debt of the Popular

A few hours before holding its last General Meeting of Shareholders, in April 2017, the Banco Popular council approved a capital plan with more than a dozen concrete proposals to clean up the entity and try to end the stock market and reputational crisis. which was submitted from a year earlier.

This document, which EL MUNDO has accessed, detailed among other measures the benefits derived from the sale of the bank's stake in six subsidiaries, the issuance of new capital instruments and, ultimately, a sharp reduction in credit to its customers to reduce your risks and free up capital.

The plan prepared by the bank's general technical secretariat and dated March 2017 proposed that this tightening be carried out by raising the price of its credits or directly increasing the risk parameters of its clients to curb refinancing or the concession of new lines. The bank then led the SME segment, which accounts for 99% of the country's business fabric.

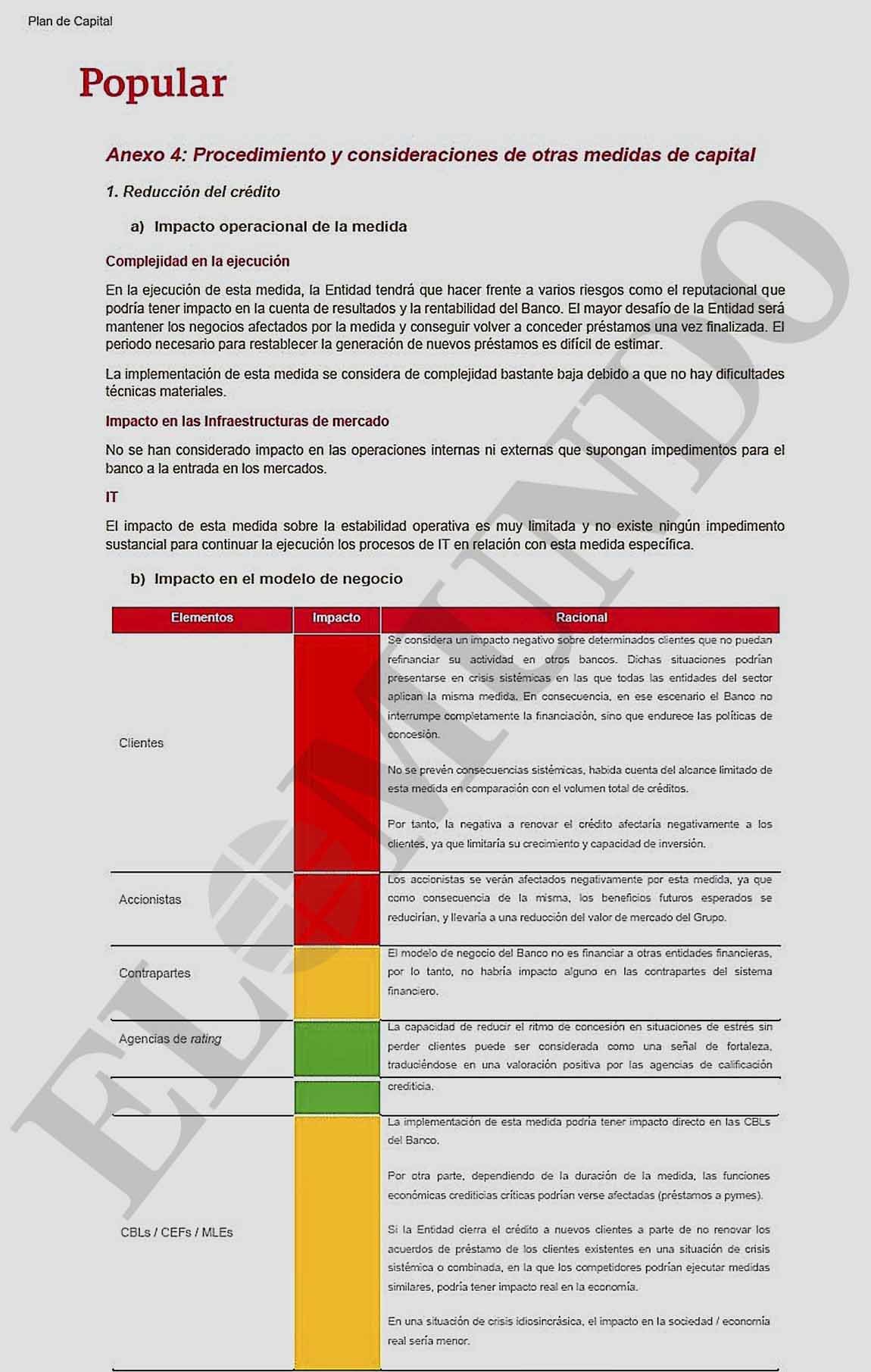

However, the document itself - which was never executed despite being approved by the board - warns that a drastic measure such as credit reduction would have a negative impact on those clients who cannot refinance their activity with other banks . "These situations could arise in systemic crises in which all the entities of the sector apply the same measure ... The refusal to renew credit would negatively affect customers, as it would limit their growth and investment capacity, " said the plan.

But customers would not be the only ones who would be affected by the closure of the tap in the Popular. The capital plan also identifies a risk of impact on shareholders "by the reduction of expected future benefits and reduction of the group's market value" as a result of the measure.

The technicians who prepared the report under the direction of CEO Pedro Larena , who resigned from the board of directors in which the plan was approved, warned that this measure would also entail risks to the bank. Among these they cited "a reputational risk due to customers changing their services to the competition and, in the worst case, a leakage of deposits . "

"The competition would try to increase the market share at the expense of the entity and profitability would suffer due to the reduction of income. This would generate not only dissatisfied customers , but also dissatisfied shareholders for the reduction in dividends." In fact, the communication plan internally urged the staff to prepare for the probable reception of a large number of complaints and claims and the elaboration of a script so that the members of the branches could give the pertinent explanations.

"Possible claims for damages"

In this regard, the Risk department also warned that the measure could have legal consequences since in the loan agreements with its clients there were no special provisions that would allow the entity to suspend the credits for its financial or capital problems. "The bank could commit contractual violations and expose itself to claims for damages," the plan says.

Instead, the benefits linked to the measure would pass according to the same document because of the speed and agility with which it could be carried out by not having to go through the board of directors. This differentiated it from other alternatives such as the sale of the subsidiaries Totalbank, Targobank, Wizink, the Mexican Ve por Más, the private banking division or the shares in the Allianz insurance company, which would have to be analyzed by the directors and subject to processes regulatory and supervision outside the entity. "It is necessary to transmit instructions to the branch network through the usual channels. The modification of the system parameters for the automatic acceptance of operations is immediate (in one day)," he said.

Around Angel Ron , who had left the bank in December, they point out that this plan enabled the management team headed by Emilio Saracho to take different measures with which he could raise capital by more than 3,000 million euros and stabilize the bank.

From the part of Saracho this extreme is denied and they allege that the bank needed almost three times as much funds as those provided for in the plan, which is why its solution was going through a new capital increase or a merger, as he wielded in his speech before the shareholders of the same April 3.

In addition, sources close to the financial executive argue that on that same day Ignacio Sánchez-Asia had been appointed as new CEO in place of Pedro Larena, so he needed some time to adapt and revise the plan before acting. Two months later the bank was intervened and bought for one euro by Banco Santander.

According to the criteria of The Trust Project

Know moreBANCABanco Santander completes the ERE with 3,030 voluntary adhesions

BancaBanco Santander repeats as the only Spanish entity of global systemic importance in 2021

BancaBankia, at the political crossroads: the chimera of a public bank