- This is how the economy arrives at 10-N (II). The lower dynamism of the economy reduces the rate of revenue growth to just over 2% and especially affects VAT

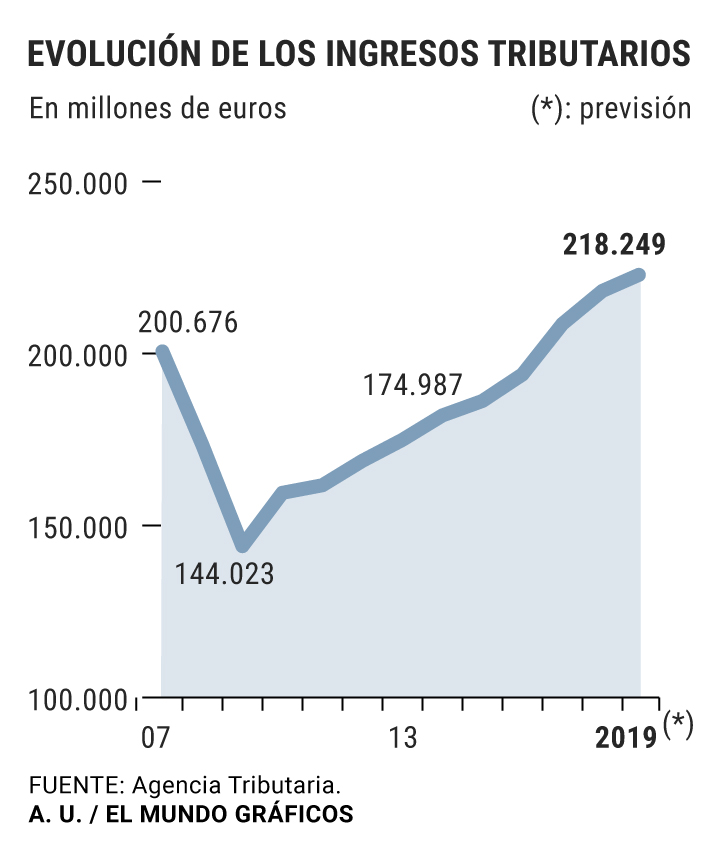

Tax collection barely grows. The cooling of the economy is conditioning the tax revenues in a remarkable way, so much so that at the end of October the variation with respect to last year was only 0.8%. 181,586 million in 2018 for the 183,110 million of this year. Some figures also show that the estimate for the whole of the year carried out by the Government of Pedro Sánchez was, at least, somewhat optimistic. And moreover, in order for the figure that the Treasury continues to defend that it will reach at the end of the year to be fulfilled, the Tax Agency would have to raise just over 35,000 million in just two months .

This moderation in the rate of collection is especially noticeable in the Corporation Tax and in the Value Added Tax (VAT). In the first, in the figure paid by companies, the accumulated until October left a crash of 11.6% compared to the same month of 2018 . The Tax Agency justifies this fall by pointing out that, in 2018, five large business groups "declared few benefits in the first installment payment and an abnormally high amount in the second", which "resulted in a very high level of income in October of 2018 that more than compensated for the bad results of the first payment ".

Without these five groups, they continue from the Treasury, the second installment payment of this year would have grown by 3.4%, a figure that in any case would continue to be below 4.9% of the first payment. And, in any case, this circumstance does not obviate the fact that the aforementioned tax has behaved worse than in 2018 during almost all of this year . For the year as a whole, the Ministry anticipated that Societies would contribute 26,063 million, which represents around 6,000 million more than the amount accumulated until October.

As for VAT, the lower economic dynamism is translating into that this tax has raised just over 64,000 million, which represents a slight increase of 1.9% . The rebound is in line with those already shown in the previous months, and contrasts with the 10% increase that accumulated in the same month last year or 12% that grew in September 2018, for example.

The worst evolution is closely linked to the fall in consumption, in domestic demand , a situation that many organizations have alerted and that is one of those responsible for the economic slowdown. A very obvious example is the fall in the sale of new homes, which significantly reduces VAT revenues and shows the deterioration of the economic context.

The personal income tax and salary increase

The Income Tax for Individuals (Personal Income Tax), for its part, is showing a more positive behavior . The percentage variations do not reach those of last year, but we must also take into account that the higher the figures, the more complex it is to achieve high growth. And it should not be forgotten that personal income tax is the tax that contributes the most income.

Thus, until October it accumulates a little more than 73,600 million, 4.6% more than in the first 10 months of 2018. Tax sources explain that much of the progress is due to the improvement that salaries have registered in Spain , which evidently it results in greater taxation for this figure. But even so, the objective of the year seems ambitious since the forecast is that it contributes a total of 86.126 million, which requires that almost 13,000 million more be raised.

And if this is added to the increase that the special taxes and the fall of all that are grouped in the rest, and that represent the smallest figure of the main tax groups, the aforementioned 183,110 million accumulated until October are reached . Many voices had already warned that figures from previous months showed that it would be very difficult to achieve the objectives set by the Treasury, that Sánchez's forecast was inflated. And the data seems to confirm that impression, although from the Treasury it is maintained that the objective remains feasible.

According to the criteria of The Trust Project

Know more- Tax agency

- Spain

- Taxes

This is how the economy arrives at 10-N (II) The slowdown also infects tax collection

Globally, Hacienda reveals that Spanish multinationals only pay 12.6% of their profits for companies

Politics The PP accelerates the tax cuts in its autonomies as "counterweight" to the PSOE pact and United We