Macroeconomic data has been imposed on economic slowdown, global instability and national political uncertainty in the decision of the S&P rating agency, which on Friday improved the rating of Spanish debt from A- to A, with a stable outlook . The agency has taken into account that the Spanish economy grows above the Eurozone average and maintains a positive performance, despite the lack of political understanding that has put the country in the face of new general elections - the fourth in four years - next November 10.

Investors and businessmen have long demanded the need for a solid Executive that allows to unlock regulatory paralysis and put in place the necessary measures to face the country's economic challenges and face the end of the expansive cycle in which we find ourselves. However, the rating firm does not believe that this situation weighs, for now, on the country's economic commitments.

The Government has confirmed the agency's diagnosis in a statement that "S&P emphasizes the progress in fiscal consolidation, which will allow the deficit to be in 2019 at around 2%, the lowest since 2007. It also shows that the more balanced economic growth and the improvement of the fiscal position are allowing a firmer reduction in the debt / GDP ratio. "

According to the data of the Bank of Spain, the debt represents 97.61% of the national Gross Domestic Product, while the deficit , according to Eurostat figures, reaches 2.48%.

A change in the sovereign debt rating directly affects the financing costs of the country, so that an improvement reduces those costs. At the same time, it also coincides that the ECB has launched new expansive measures to contain the slowdown of the economy, a movement that relaxes the pressure on the debt of the member states. And that shows. The Spanish risk premium, which is one of the thermometers to test this pressure and that exceeded 600 points at the most critical moments of the crisis, remains stable at around 75 integers, with the profitability of the Spanish bond to 10 years at 0.23%, compared to -0.52% of the comparable German taken as a reference.

That is, investors continue to show interest in Spanish securities. In the last auction of the Public Treasury, the agency placed 3,970 million euros in bonds and obligations at lower rates than in previous references, with a demand that exceeded 5,587 million euros.

In fact, despite the parliamentary instability of the legislature governed by Pedro Sánchez, the Ministry of Economy has twice reduced the net issuance of the Treasury by 2019, to 20,000 million, compared to the 35,000 initially planned. At the same time, the planned gross emission is also reduced until reaching, for the first time since 2011, below 200,000 million euros, specifically up to 194,525 million euros, 8.7% lower than the previous year.

DBRS

Also the DBRS rating agency has published its diagnosis of Spanish debt this Friday, confirming the note of A but changing its perspective to positive. The Canadian-based firm believes that "the conditions that supported Spain's solid economic growth and the constant improvements in public finances in recent years should continue to underpin its credit metrics."

The agency is confident that the Executive will continue to reduce its debt levels in the coming years "aided by primary surpluses, low interest rate environment and nominal GDP growth."

DBRS alludes to the complex political landscape in Spain, but does not believe that the hypothetical irruption of "popular" forces varies the country's economic economy in a worrying way. "DBRS does not expect the next national government to implement abrupt policy changes that would challenge that assessment, although less popular measures that could structurally improve fiscal or economic results could be further delayed," he says in his report.

According to the company, the deterioration of the global context and the intensification of external risks are the main threats to the country, however, "a slowdown but still dynamic of the labor market and the tail winds of monetary policy will continue to support domestic demand "Spanish and will play in favor of its economy.

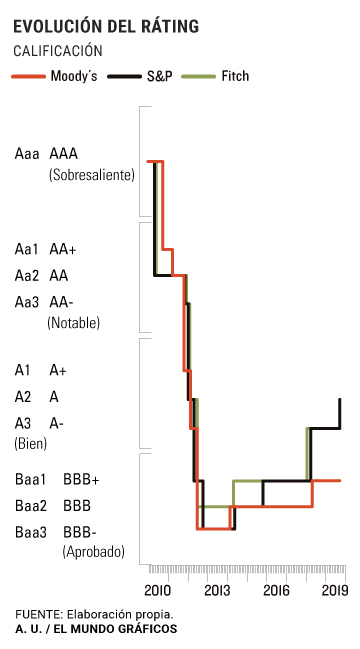

The next revision will take place on November 15, when Fitch gives his verdict on the Spanish debt, and almost a month later, on December 13, Moody's will be pronounced.

According to the criteria of The Trust Project

Know more